Content

Or, more specifically, it’s because of failure to follow the full disclosure principle. The generally accepted accounting principle behind this advice is the business entity assumption. Basically, this principle means that a business is an entity unto itself, and should be treated as such (which is also why this is sometimes called the “separate entity assumption”).

Finding funding for your business is a process that takes a lot of time and effort, especially during the startup phase. Many entrepreneurs fail in their first attempts at fundraising because they are poorly prepared. In addition to the FASB, the American Institute of Certified Public Accountants (AICPS), the SEC and the Governmental Accounting what is gaap Standards Board (GASB) are the core organizations that influence GAAP. Finally, the principle of utmost good faith requires that an accountant will always tell the truth and operate in good faith as part of their duties. Some have argued that a combination of the two frameworks is more advantageous than either convention on its own.

Guide to Understanding (GAAP) Generally Accepted Accounting Principles

GAAP is a set of detailed accounting guidelines and standards meant to ensure publicly traded U.S. companies are compiling and reporting clear and consistent financial information. Any company following GAAP procedures will produce https://www.bookstime.com/articles/direct-write-off-method a financial report comparable to other companies in the same industry. This provides investors, creditors and other interested parties an efficient way to investigate and evaluate a company or organization on a financial level.

Publicly traded companies, and some others, are required by law to use GAAP for their reporting. Here’s the history of how GAAP became the standard financial reporting measure for the U.S. Privately held companies and nonprofit organizations also may be required by lenders or investors to file GAAP-compliant financial statements. For example, annual audited GAAP financial statements are a common loan covenant required by most banking institutions.

What are the generally accepted accounting principles?

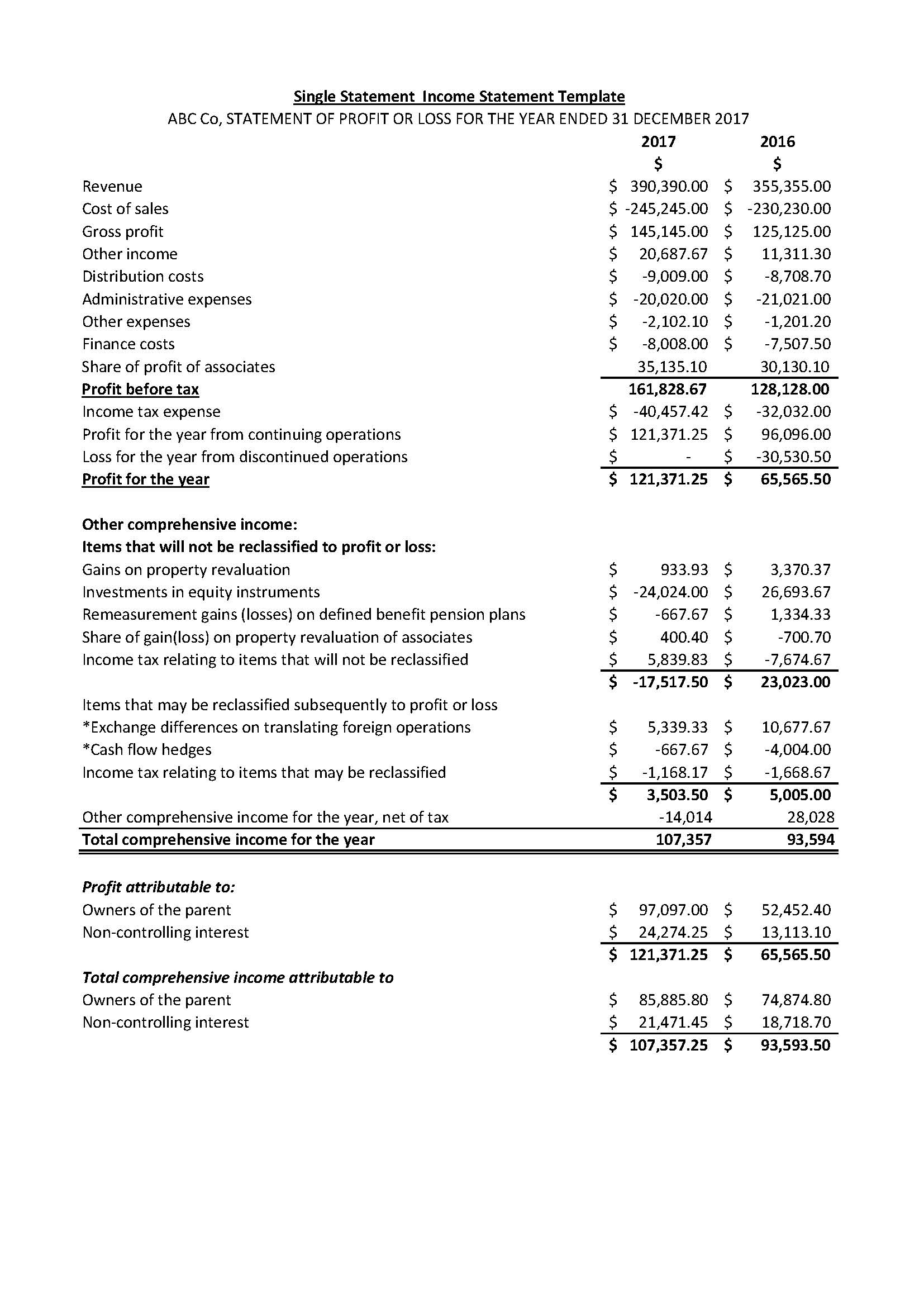

The principle of recognition applies in this case because there is a question of how to account for this sale. That is, there is a contract that represents the account receivable, but the cash has not yet landed in the seller’s accounts. Since the GAAP relies on accrual accounting, the sale is recognized on the balance sheet and as part of the company’s overall value. However, it does not receive recognition on the cash flow statement because that sales revenue cannot yet be used to pay debts or regular bills.

- Any external party looking at a company’s financial records will be able to see that the company is GAAP compliant, making it both easier to attract investors and to successfully pass external audits.

- Many countries around the world have adopted International Financial Reporting Standards (IFRS).

- This is also one of the trickier principles, because it can be hard to quantify.

- While the two systems have different principles, rules, and guidelines, IFRS and GAAP have been working towards merging the two systems.

- GAAP rules are maintained by the Financial Accounting Standards Board (FASB) and in place to help protect business owners, consumers, and investors from fraud.

- Each will have a balance sheet, income statement, and cash flow statement, for instance.

Rather, particular businesses follow industry-specific best practices designed to reflect the nuances and complexities of different business areas. For example, banks operate using different accounting and financial reporting methods than those used by retail businesses. There is plenty of room within GAAP for unscrupulous accountants to distort figures.

Users of GAAP

Accountancy is often referred to as an art – the art of recording, classifying and summarizing financial information. As is the case with any form of art, accountancy also involves the use of one’s creative skills, to maintain a record of financial transactions. However, if free rein is given on the system of accountancy to be followed, there will be no limit on the scope of manipulation of accounts.

- Basically, this principle means that a business is an entity unto itself, and should be treated as such (which is also why this is sometimes called the “separate entity assumption”).

- IFRS focuses more on general principles than GAAP, which makes the IFRS body of work much smaller, cleaner, and easier to understand than GAAP.

- The IFRS is used in over 100 countries, including countries in the European Union, Japan, Australia and Canada.

- The International Financial Reporting Standards (IFRS) is the most common set of principles outside the United States.

- These principles are largely set by the Financial Accounting Standards Board (FASB), an independent nonprofit organization whose members are chosen by the Financial Accounting Foundation.

- In practice, since much of the world uses the IFRS standard, a convergence to IFRS could have advantages for international corporations and investors alike.

- They also draw on established best practices governing cost, disclosure, matching, revenue recognition, professional judgment, and conservatism.